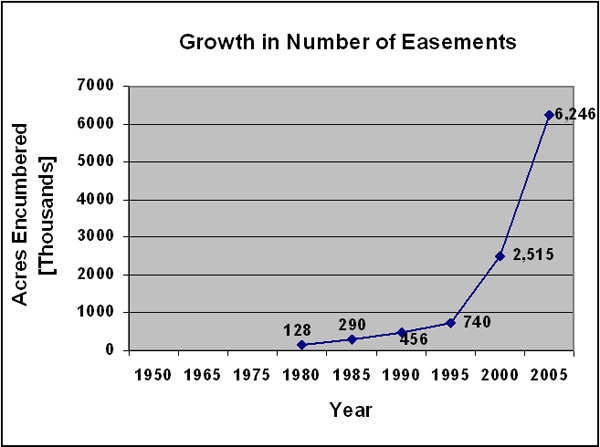

Waisted Space: Conservation Easements-- By MichaelHilton - 17 Apr 2010Conservation Easements OverviewConservation easements are a form of covenant which place restrictions on the use of land, and the ability to enforce this restriction is typically given to a third party such as the local government or a charitable trust. Additionally, this covenant runs with the land, and is enforceable against any owner who comes into possession. Most states today have passed legislations specifically authorizing the creation and continuation of this type of covenant. Conservation easements have only recently started gaining in popularity, growing from 2,514,566 acres affected in 2000 to 6,245,969 in 2005, an increase of 148% in a five year period. Conservation easements essentially allow a land owner to create a covenant, restricting their own options for the use of land as well as the options to which their heirs and successors possess. Conservation easements act as a bar to commercial development and subdivision, thereby ensuring the landowner’s peace of mind by giving him the knowledge his land will remain unchanged by the hands of developers, even long after his death. Furthermore, there are a variety of different tax breaks given to owners who donate conservation easements to local governments or charitable land trusts, so long as these easements fall under a rather wide range of purposes. Ostensibly, these tax breaks are given to reflect the creation of some public benefit. Whatever the benefit of conservation easements may be, I believe that there is ample evidence to show that the existence of this particular brand of covenant is in conflict with traditionally held notions of property ownership as well as established property doctrine.Problems with Conservation EasementsRestraint on AlienationProperty law has long operated under the logic that there should be few restraints on alienation of property held in fee simple. However, the main point of conservation easements is to implement restrictions on the different uses of the land, and this has the effect of limiting who an individual can sell their land to. Because conservation easements forbid subdivisions and development of the land, the inheriting owner is left with few options. They may either continue to own the property and pay taxes on it, or sell it for a reduced price to another, who will be similarly restricted. American courts have been very hesitant to recognize restrictions attached to the alienability of inherited land, holding that such a testamentary device resembles too closely the traditional English fee tail which restricted the right of ownership to a piece of land to a particular class. This principle can be seen in the case of Johnson v. Whiton, in which the court refuses to recognize the provisions of a will which restrict who may come to own the land in question.RAPAnother piece of property law which seems to conflict with the ability of a property owner to set terms and conditions regarding the use of land which are to remain in effect perpetually is the common law Rule against Perpetuities. While not all states have or still enforce their Rule against Perpetuities, a majority of states still do, which suggests that the majority logic still supports the basic idea behind the rule. The Rule against Perpetuities is designed to protect against dead hand control of land for longer than one generation. In other words, an owner can use his will to determine the uses to which his land is put by his children, but cannot dictate the use to which it is put by his grandchildren. Furthermore, it has been recognized in the case Eyerman v. Mercantile Trust Co. (a case in which the court refused to uphold provisions of the intestate’s will) that dead hand control of land by a former owner within the immediately following generation will not be recognized if it operates to cause a waste of resources directly affecting important interests of other members of that society. It is possible that not only the inheritors of a conservation easement will be faced with wasted resources (in not being able to develop their land), but their neighbors may also experience a decrease in land value due to their proximity to land where development is restricted.Tax BenefitsA final concern regarding conservation easements is their recent and startling explosion in popularity. Conservation easements only began growing in popularity once they became a tax-deductible interest following amendments to the Internal Revenue Code in 1976. Since it is possible for current owners to gain substantial tax deductions for donating conservation easements to local governments or approved charitable trusts, there is the possibility that many owners will act only in accordance with their own interests, not taking into consideration the effect a perpetual covenant will have on future generations who will come to own the land. Additionally, due to the exponential nature of conservation easement creation there is a substantial risk that the oversight mechanisms in place have been overwhelmed to the point where donors have the opportunity to overvalue their property without running a substantial risk of being caught. This situation creates the likely scenario that land owners can gain more individual benefit in the form of tax reductions than there is public benefit created from the preservation of the land, creating a significant public waste. While conservation easements could potentially be employed to the benefit of the general public, there would need to be more thorough evaluation of owners’ claims before the tax benefit is granted to make sure the preservation of the land will really result in public gain. As things stand at the moment conservation easements are granted for fairways on private golf courses and Nantucket cottages belonging to the wealthy, not the type of conservation likely to result in utility for the general public. Conservation easements only began growing in popularity once they became a tax-deductible interest following amendments to the Internal Revenue Code in 1976. Since it is possible for current owners to gain substantial tax deductions for donating conservation easements to local governments or approved charitable trusts, there is the possibility that many owners will act only in accordance with their own interests, not taking into consideration the effect a perpetual covenant will have on future generations who will come to own the land. Additionally, due to the exponential nature of conservation easement creation there is a substantial risk that the oversight mechanisms in place have been overwhelmed to the point where donors have the opportunity to overvalue their property without running a substantial risk of being caught. This situation creates the likely scenario that land owners can gain more individual benefit in the form of tax reductions than there is public benefit created from the preservation of the land, creating a significant public waste. While conservation easements could potentially be employed to the benefit of the general public, there would need to be more thorough evaluation of owners’ claims before the tax benefit is granted to make sure the preservation of the land will really result in public gain. As things stand at the moment conservation easements are granted for fairways on private golf courses and Nantucket cottages belonging to the wealthy, not the type of conservation likely to result in utility for the general public.

ConclusionConservation easements, due to their perpetual nature, restraints on alienation, and questionable public utility, need to be examined closely and redefined to fit traditional norms of property law.You are entitled to restrict access to your paper if you want to. But we all derive immense benefit from reading one another's work, and I hope you won't feel the need unless the subject matter is personal and its disclosure would be harmful or undesirable. To restrict access to your paper simply delete the "#" on the next line: # * Set ALLOWTOPICVIEW = TWikiAdminGroup, MichaelHilton Note: TWiki has strict formatting rules. Make sure you preserve the three spaces, asterisk, and extra space at the beginning of that line. If you wish to give access to any other users simply add them to the comma separated list |

|